WASHINGTON (AP) — U.S. House leaders are calling on CrowdStrike CEO George Kurtz to testify to Congress about the cybersecurity company’s role in sparking the widespread tech outage that grounded flights, knocked banks and hospital systems offline and affected services around the world.

CrowdStrike said this week a “significant number” of the millions of computers that crashed on Friday, causing global disruptions, are back in operation as its customers and regulators await a more detailed explanation of what went wrong.

Republicans who lead the House Homeland Security committee said Monday they want those answers soon.

“While we appreciate CrowdStrike’s response and coordination with stakeholders, we cannot ignore the magnitude of this incident, which some have claimed is the largest IT outage in history,” said a letter to Kurtz from Rep. Mark E. Green of Tennessee and Rep. Andrew Garbarino of New York.

They added that Americans “deserve to know in detail how this incident happened and the mitigation steps CrowdStrike is taking.”

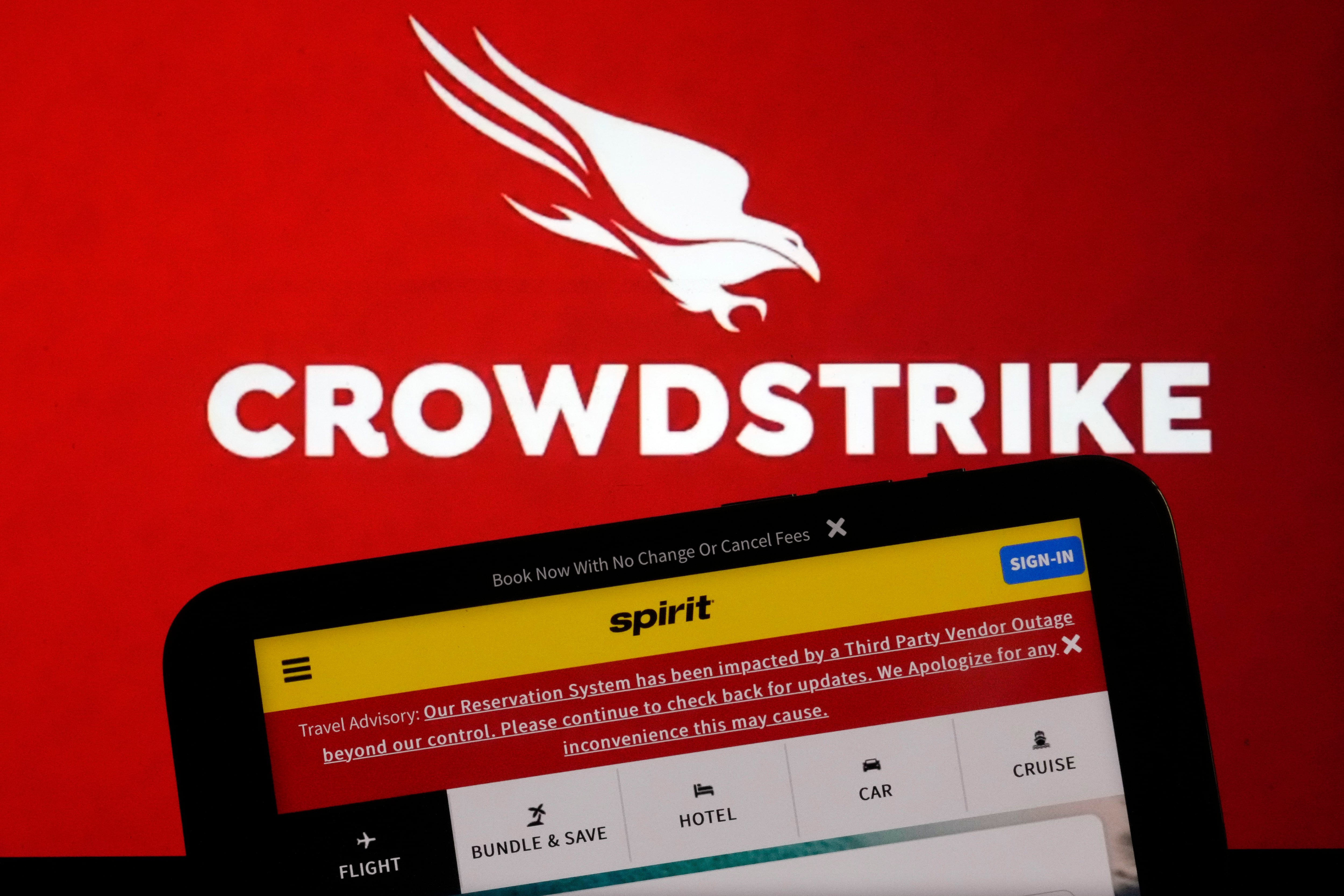

A defective software update sent by CrowdStrike to its customers disrupted airlines, banks, hospitals and other critical services Friday, affecting about 8.5 million machines running Microsoft's Windows operating system. The painstaking work of fixing it has often required a company's IT crew to manually delete files on affected machines.

CrowdStrike said late Sunday in a blog post that it was starting to implement a new technique to accelerate remediation of the problem. It also said in a brief statement Monday that it is actively in contact with congressional committees.

Shares of the Texas-based cybersecurity company have dropped more than 20% since the meltdown, knocking off billions of dollars in market value.

The scope of the disruptions has also caught the attention of government regulators, including antitrust enforcers, though it remains to be seen if they take action against the company.

“All too often these days, a single glitch results in a system-wide outage, affecting industries from healthcare and airlines to banks and auto-dealers,” said Lina Khan, chair of the U.S. Federal Trade Commission, in a Sunday post on the social media platform X. “Millions of people and businesses pay the price. These incidents reveal how concentration can create fragile systems.”