*By Conor White*

With the company's first manufacturing plant in China up and running, the chief executive of Align Technology, the maker of Invisalign orthodontics, isn't concerned about a possible trade war between the United States and China.

"By the end of the year we'll have a good, contained business in China, and be able to service our Chinese business," said Joe Hogan, the CEO of Align Technology. "So I feel great about the moves we've made there, given the talks that are going on."

Align's stock was the top performer on the S&P 500 in the last year, soaring 132 percent in 2017. The company's management has said sales could top $2 billion by 2020.

To reach that goal, the company is reaching out directly to consumers who may need its Invisalign products: clear, plastic teeth aligners taking the place of traditional metal braces.

"We have a really strong consumer business, in the sense that we advertise to consumers, and direct them toward doctors," Hogan said in an interview Tuesday with Cheddar. "So the consumer awareness part of this is a big part of this strategy also."

Consumers are increasingly aware: Invisalign shipments are up more than 30 percent year-over-year in the first quarter of this year.

For the full interview, [click here](https://cheddar.com/videos/stars-align-for-invisalign).

With the New Year around the corner, it's time to start thinking about resolutions. Many folks begin to think about saving money or cutting down on bills. Caleb Silver, editor-in-chief of Investopedia, joined Cheddar News to provide some tips on tracking debt and staying organized.

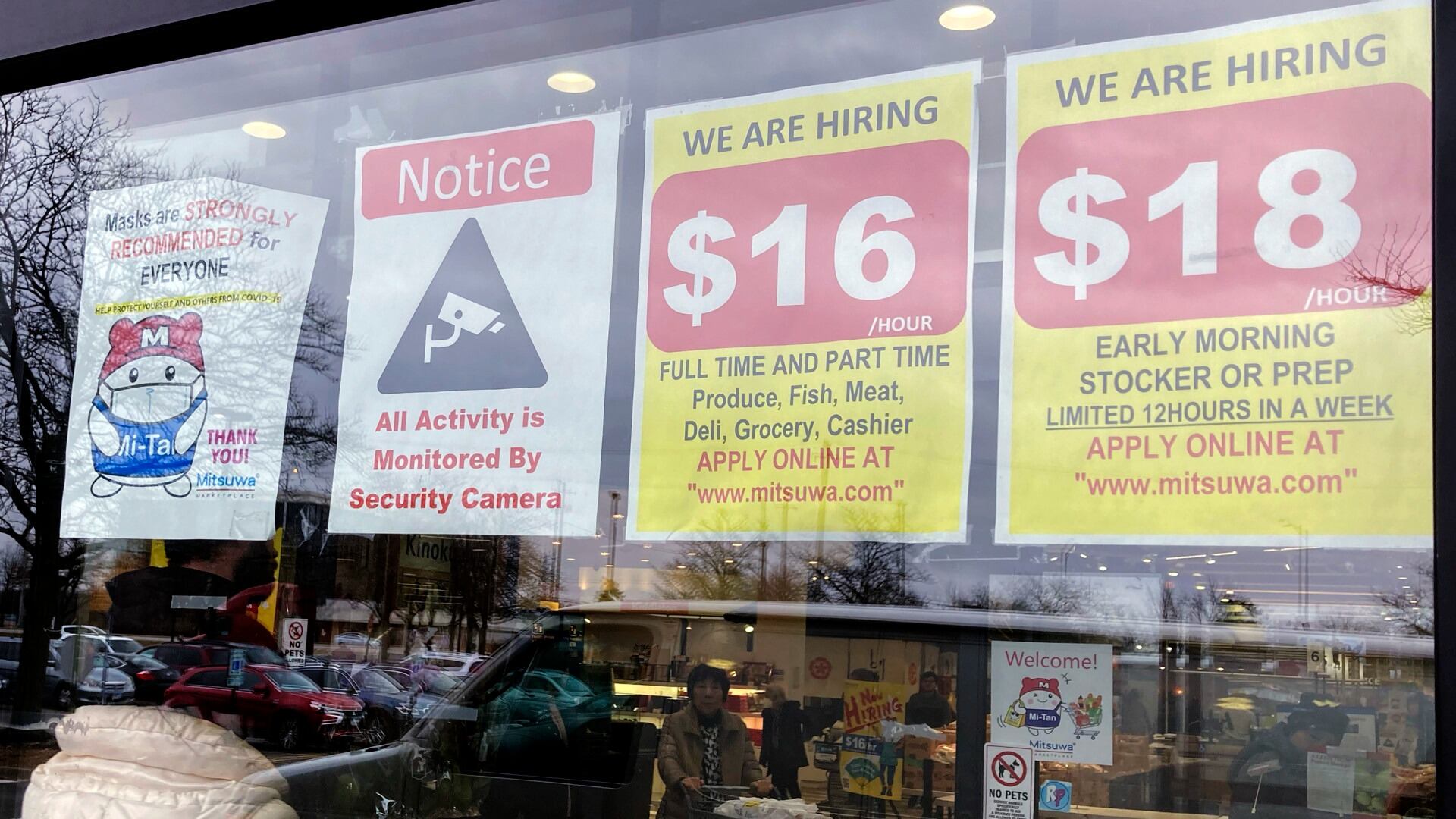

Half of U.S. states are raising their minimum wage next year.

Sony's PlayStation 5 console has now passed 50 million units sold.

FedEx decreased its full-year revenue forecast after reporting lower-than-expected quarterly profits in its latest results.

Cora is among dozens of young kids across the U.S. poisoned by lead linked to tainted pouches of the cinnamon-and-fruit puree

The IRS said Tuesday it is going to waive penalty fees for people who failed to pay back taxes that total less than $100,000 per year for tax years 2020 and 2021.

Rite Aid has been banned from using facial recognition technology for five years over allegations that a surveillance system it used incorrectly identified potential shoplifters, especially Black, Latino, Asian or female shoppers.

The union representing Southwest Airlines pilots says it reached a new contract agreement in principle with the airline following three years of negotiations.

U.S. Bank has been hit with a $36 million fine for freezing debit cards that distributed unemployment benefits during the pandemic.

Construction of new homes rose by double digits in November, according to data from the Commerce Department.