Shares of Google parent Alphabet soared to all-time highs Monday evening, after the company posted a surge in ad revenue that partially made up for a record-breaking $5 billion fine from the EU.

MarketWatch tech reporter Max Cherney said that even recent backlash over ad placement on the site won't ultimately deter customers.

"Google has to make sure their advertising clients are happy with the placement of their ads," he told Cheddar after the results. "Even though Google has struggled with the issue, and YouTube specifically...at the end of the day Google offers very valuable advertising real estate and most, if not all, of their customers end up going back."

Advertising revenue for the quarter rose nearly 25 percent to $28.1 billion in the second quarter. That increase came despite a [CNN report in April](https://money.cnn.com/2018/04/19/technology/youtube-ads-extreme-content-investigation/index.html) that found ads for 300 companies, from Adidas to Hershey to Netflix, appeared next to questionable YouTube content. The company had been plagued by similar scandals throughout last year.

Still, research firm eMarketer estimates Google will control 31 percent of the digital ad market this year.

On the company's conference call, CFO Ruth Porat said, "One of the biggest opportunities for investment continues to be our ads business, where we're continuing to invest meaningfully."

While the EU fine, announced last week as a penalty for abusing the market dominance of its Android operating system, did eat into profit, on an adjusted basis the company posted earnings of $11.75 a share, ahead of analyst estimates for $9.59.

Another good signーAlphabet also saw slowing growth in its so-called traffic acquisition costs, or how much the company pays to drive views to its sites.

Overall revenue came in at $32.7 billion for the quarter. Sales from its "Other Bets", which include Google's cloud business and hardware division, rose nearly 50 percent to $145 million.

For full interview, [click here](https://cheddar.com/videos/alphabet-hits-all-time-high-after-reporting-q2-earnings).

Consider this your sign to pack your bags. Airbnb says Colorado Springs will be a top travel destination in 2024.

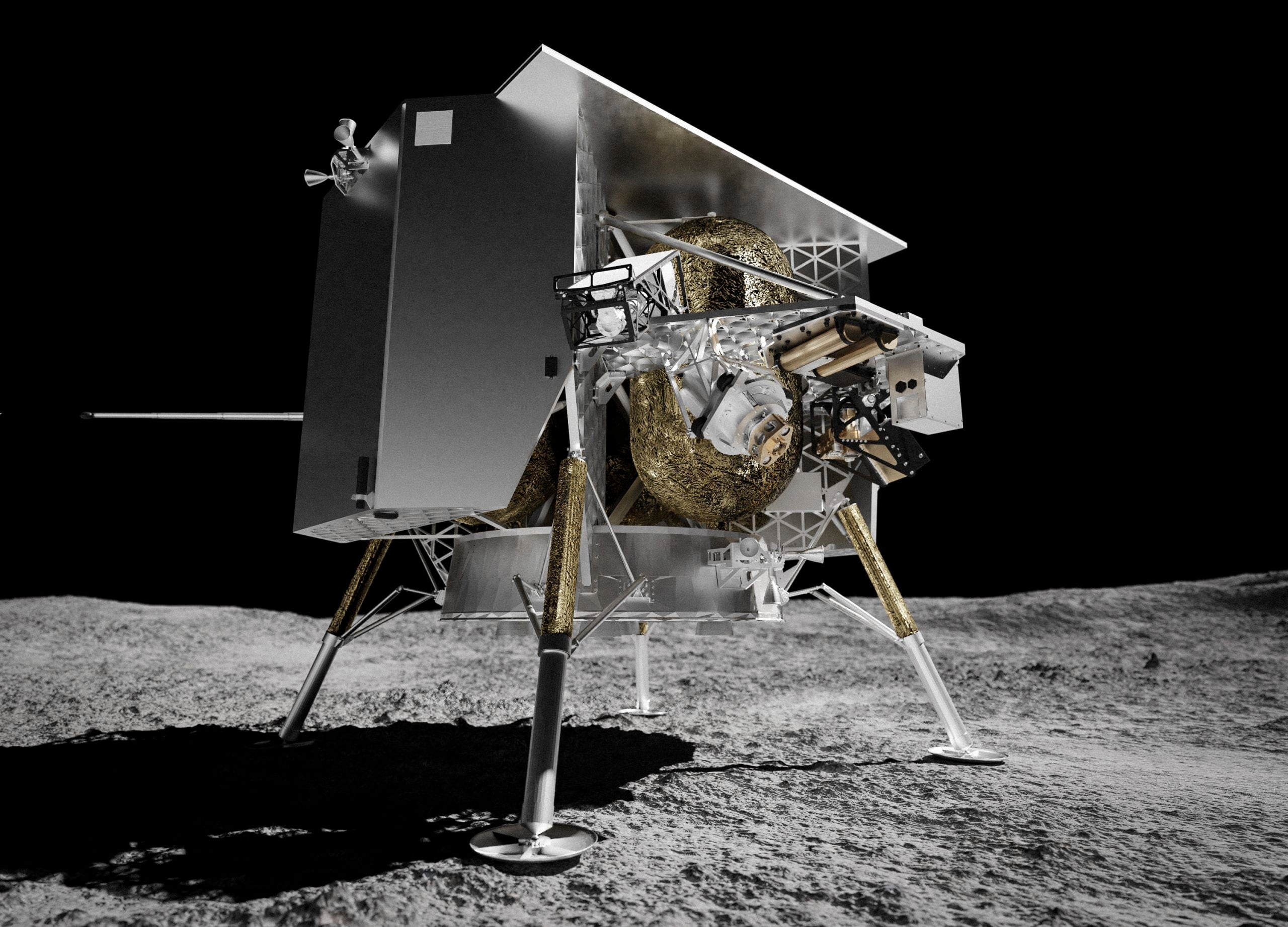

A moon landing attempt by a private US company appears doomed because of a fuel leak on the newly launched spacecraft. Astrobotic Technology managed to orient the lander toward the sun Monday so its solar panel could capture sunlight and charge its onboard battery.

Treasury Secretary Janet Yellen has announced that 100,000 businesses have signed up for a new database that collects ownership information intended to help unmask shell company owners. Yellen says the database will send the message that “the United States is not a haven for dirty money.”

A new version of the federal student aid application known as the FAFSA is available for the 2024-2025 school year, but only on a limited basis as the U.S. Department of Education works on a redesign meant to make it easier to apply.

A steep budget deficit caused by plummeting tax revenues and escalating school voucher costs will be in focus Monday as Democratic Gov. Katie Hobbs and the Republican-controlled Arizona Legislature return for a new session at the state Capitol.

The first U.S. lunar lander in more than 50 years is on its way to the moon. The private lander from Astrobotic Technology blasted off Monday from Cape Canaveral, Florida, catching a ride on United Launch Alliance's brand new rocket Vulcan.

Global prices for food commodities like grain and vegetable oil fell last year from record highs in 2022, when Russia’s war in Ukraine, drought and other factors helped worsen hunger worldwide, the U.N. Food and Agriculture Organization said Friday.

Wall Street is drifting higher after reports showed the job market remains solid, but key parts of the economy still don’t look like they’re overheating.

The Biden administration is docking more than $2 million in payments to student loan servicers that failed to send billing statements on time after the end of a pandemic payment freeze.

The nation’s employers added a robust 216,000 jobs last month, the latest sign that the American job market remains resilient even in the face of sharply higher interest rates.