Shares of Target fell Tuesday morning after the company said higher wages put pressure on profits during the holiday quarter. And Amazon shares are at a new record high, thanks to a new $2,000 price target from Monness Crespi.

Plus we speak with the SVP of global brands at Wyndham about the company's plans to spin off its vacation ownership business into a separate public company, as well as a new feature that gets you to unplug.

And Spotify and Dropbox have both filed to go public in recent weeks. We take a look at how the offerings may fare and what precedent they set for the IPO market this year.

Analysts at Baird reiterated their "outperform" rating on Apple stock, with a price target of $200. Kristen Scholer and Tim Stenovec walk you through setting a limit sell order on the TradeStation platform if you want to lock in gains if and when the stock hits that level.

Gift cards make great stocking stuffers — just as long as you don't stuff them in a drawer and forget about them after the holidays.

Big Business This Week is a guided tour through the biggest market stories of the week, from winning stocks to brutal dips to the facts and forecasts generating buzz on Wall Street.

Bristol Myers Squibb agreed to buy schizophrenia drug maker Karuna Therapeutics in a $14 billion deal.

Supermarket chain Ralphs is facing a new lawsuit from the state of California.

Shake Shack is giving out free fried chicken sandwiches, bacon cheese fries and milkshakes nationwide.

The IRS is announcing a voluntary disclosure program.

Lionsgate announced its studio division is going to spin off in a merger with Screaming Eagle Acquisition Corp., which is a special purpose acquisition company.

A new report suggests that it's getting more difficult for an average American to afford a home.

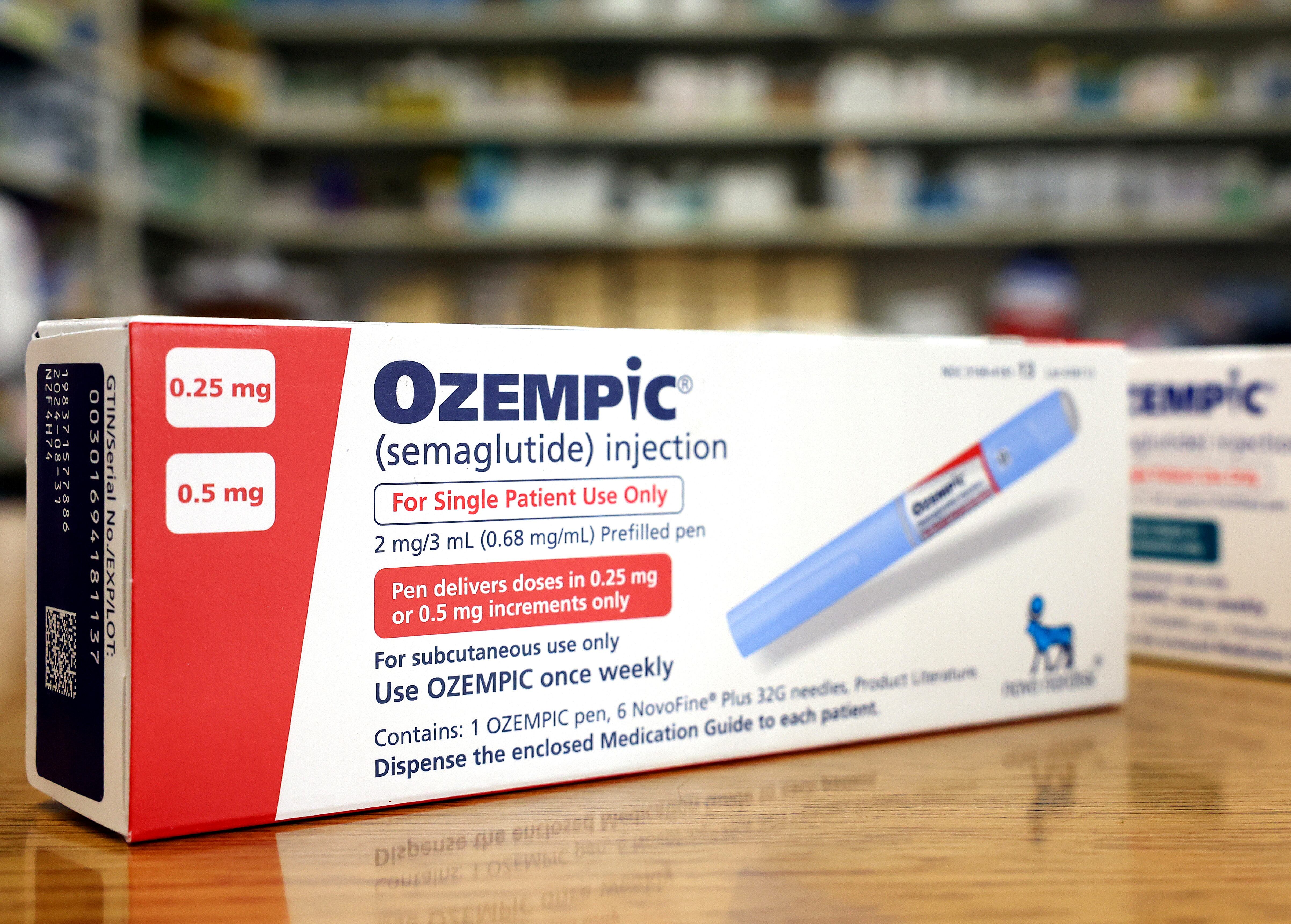

The Food and Drug Administration warned consumers about a copycat version of the diabetes drug Ozempic.

Tesla is reportedly moving forward with its plan to make energy shortage storage batteries in China.