Jon Miller, White House Correspondent for CRTV, discusses the GOP tax bill, which could be voted on as early as Tuesday. The Republican Party secured the number of votes needed to pass the bill on Friday, when Senators Marco Rubio and Bob Corker jumped on board.

Miller notes his surprise with Corker deciding to vote for the bill, given how bothered he was originally by the $1.4 trillion it would add to the deficit. We discuss how unfavorable the bill is polling with the American people. Miller adds that much of that is because he does not think the media is doing a good job of being honest about the bill. In addition to that, 45% of Americans don't actually pay taxes. Millers talks the overall good the bill will do for the economy and business-owners.

Bristol Myers Squibb agreed to buy schizophrenia drug maker Karuna Therapeutics in a $14 billion deal.

Supermarket chain Ralphs is facing a new lawsuit from the state of California.

Shake Shack is giving out free fried chicken sandwiches, bacon cheese fries and milkshakes nationwide.

The IRS is announcing a voluntary disclosure program.

Lionsgate announced its studio division is going to spin off in a merger with Screaming Eagle Acquisition Corp., which is a special purpose acquisition company.

A new report suggests that it's getting more difficult for an average American to afford a home.

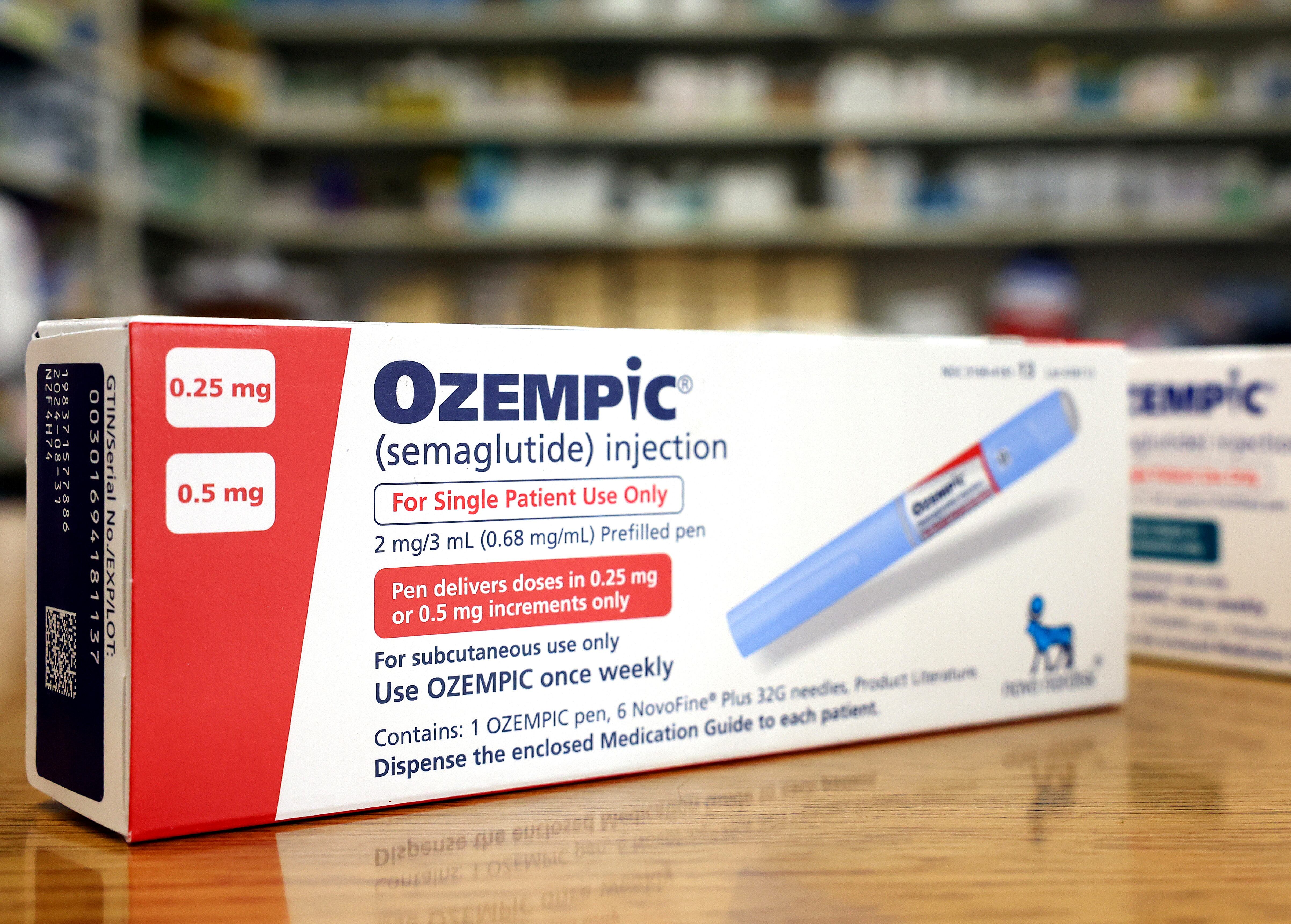

The Food and Drug Administration warned consumers about a copycat version of the diabetes drug Ozempic.

Tesla is reportedly moving forward with its plan to make energy shortage storage batteries in China.

Wells Fargo employees at a branch in New Mexico have voted to unionize.

Nike cut its full-year revenue outlook for the fiscal year after reporting lower-than-expected revenue in its latest quarter.