Entrepreneur and author of "Rich Dad Poor Dad," Robert Kiyosaki joined Cheddar to discuss his views on why the rich are getting richer!

The businessman explains that the lack of financial education in schools is a major contributor to the poor paying higher taxes. Kiyosaki says that people like himself and President Trump are rich and many others are not, because of financial literacy.

The less one knows about how to use debt and other tax-related loopholes, the more likely you are to end up paying more.

When asked about former co-author and president, Donald Trump's proposed tax cuts, he says he doesn't believe it's going to put more money back into the average person's wallet.

On the other hand, charity investments, knowledge of tax exemptions, and the likes, are rich people's way around paying taxes. He cites the system as unfair, but says someone has to pay taxes, an onus usually placed on the poor.

When it comes to charitable giving, Kiyosaki explains that a charitable remainder trust is a way to manage how your tax money is distributed. He says that charity is an essential part of being human, and people should prioritize giving to charity before paying off any debt you have.

Kiyosaki said that if he were to die today, his charitable remainder trust is set to give back $35 million yearly in perpetuity, to the causes he cares about.

With only a few days until Christmas, people are still scrambling to buy gifts for friends and family. Claudia Lombana, consumer and shopping expert, joined Cheddar News to provide tips on how to budget for those gifts.

With the New Year around the corner, it's time to start thinking about resolutions. Many folks begin to think about saving money or cutting down on bills. Caleb Silver, editor-in-chief of Investopedia, joined Cheddar News to provide some tips on tracking debt and staying organized.

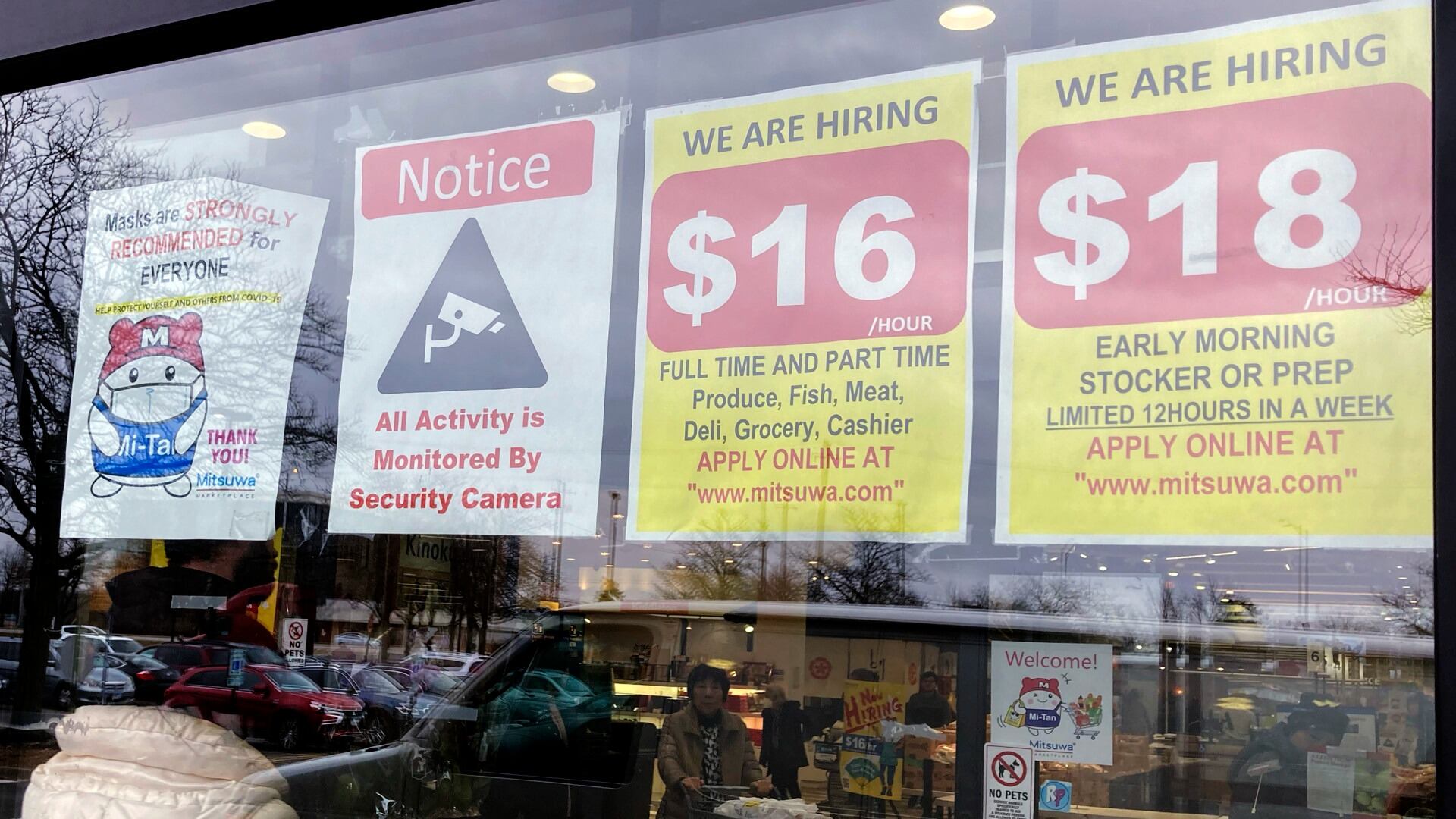

Half of U.S. states are raising their minimum wage next year.

Sony's PlayStation 5 console has now passed 50 million units sold.

FedEx decreased its full-year revenue forecast after reporting lower-than-expected quarterly profits in its latest results.

Cora is among dozens of young kids across the U.S. poisoned by lead linked to tainted pouches of the cinnamon-and-fruit puree

The IRS said Tuesday it is going to waive penalty fees for people who failed to pay back taxes that total less than $100,000 per year for tax years 2020 and 2021.

Rite Aid has been banned from using facial recognition technology for five years over allegations that a surveillance system it used incorrectly identified potential shoplifters, especially Black, Latino, Asian or female shoppers.

The union representing Southwest Airlines pilots says it reached a new contract agreement in principle with the airline following three years of negotiations.

U.S. Bank has been hit with a $36 million fine for freezing debit cards that distributed unemployment benefits during the pandemic.