You know ESPN the sports media giant. Now brace yourself for ESPN Bet, a rebranding of an existing sports-betting app owned by Penn Entertainment, which is paying $1.5 billion plus other considerations for exclusive rights to the ESPN name.

The deal, announced Tuesday, could take Walt Disney Co.-owned ESPN into uncharted waters. Disney is fiercely protective of its family-friendly image, not typically associated with the world of sports gambling.

Penn will operate ESPN Bet, which ESPN has agreed to promote across its online and broadcast platforms in order to generate “maximum fan awareness” of the app. ESPN Bet will also have unspecified “access” to ESPN talent, the companies said.

Penn's rights to the ESPN brand will initially run for a decade and can be extended for another decade by mutual agreement. In addition to the $1.5 billion licensing deal, which will be paid out over a decade, Penn will also grant ESPN rights worth about $500 million to purchase shares in Penn.

“Penn Entertainment is the perfect partner to build an unmatched user experience for sports betting with ESPN Bet,” ESPN chairman Jimmy Pitaro said in a statement.

Disney has wrestled with the issue of adult-oriented entertainment in the past. Until about 15 years ago, its Walt Disney World park in Orlando, Florida, featured a gated late-night area known as Pleasure Island — actually a reference to the 1940 film “Pinocchio,” whose characters visited a den of iniquity by that name. Pleasure Island featured bars, music venues and nightclubs in addition to restaurants, shopping and a nightly countdown to “New Year's Eve” complete with fireworks.

When attendance waned, Disney closed down the Pleasure Island nightclubs in 2008 and redeveloped the site as a restaurant and shopping district now known as The Landing at Disney Springs.

ESPN added that it will use its platforms “to educate sports fans on responsible gaming” — for instance by continuing to cover the sports betting industry with “journalistic integrity,” creating a “responsible gaming” committee within the company and developing marketing guidelines that “safeguard” fans.

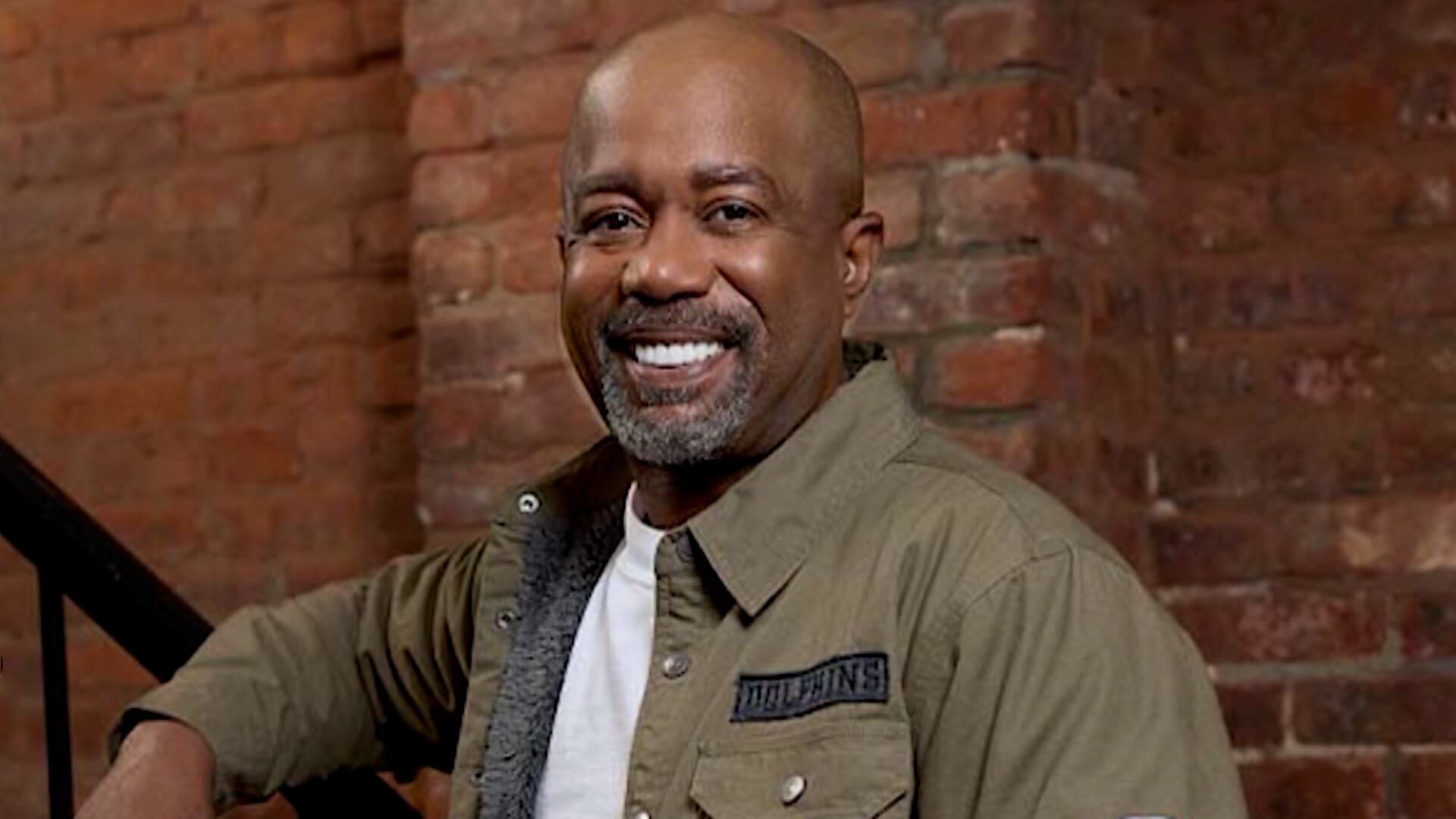

Penn also announced that it sold Barstool Sports, an irreverent sports media site, back to its founder Dave Portnoy. Penn took a 36% stake of Barstool Sports in February 2020 for about $163 million and subsequently acquired the remainder of the company for about $388 million in February 2023. Neither Penn nor Portnoy disclosed terms of the divestment deal.

In a video posted on X, the site formerly known as Twitter, Portnoy radiated excitement over the site's regained independence. The regulated gambling industry, he said, “was probably not the best place for Barstool Sports and the kind of content we make.” Portnoy added that he will “never” sell the company. As part of the divestment deal, Penn would be owed 50% of the gross proceeds from any future sale or “monetization” of Barstool.